Bookkeeping is the process of recording and systematically organizing financial transactions. It is essential for all businesses, regardless of size, but it is especially important for small businesses.

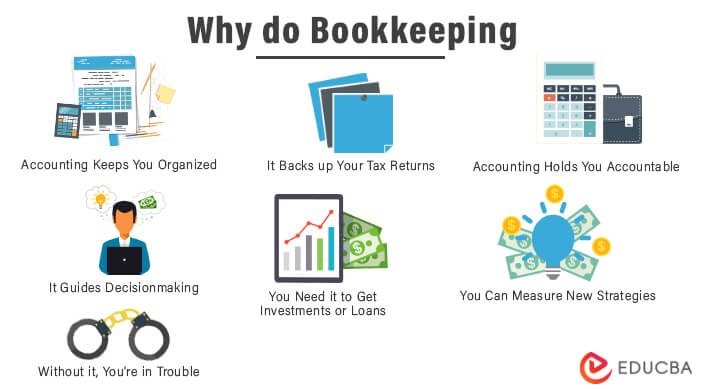

Why is bookkeeping so crucial for small businesses?

Here are just a few reasons:

- To comply with tax laws. All businesses are required to keep accurate financial records for tax purposes. Good bookkeeping makes it easy to file your taxes accurately and on time.

- To track your finances. Bookkeeping helps you track your income and expenses to see how your business performs financially. This information is essential for making sound business decisions.

- To identify areas for improvement. By tracking your finances, you can identify areas where your business is spending too much money or where you can increase your sales. This information can help you improve your profitability.

- To make better financial decisions. You can make better pricing, inventory management, and marketing decisions with accurate financial data.

- To prepare for future growth. To grow your business, you must have accurate financial information to show potential investors and lenders.

How to get started with bookkeeping

If you are new to bookkeeping, there are a few things you need to do to get started:

- Set up a chart of accounts. A chart of accounts lists your business’s financial accounts, such as cash, accounts receivable, accounts payable, and inventory.

- Record all of your financial transactions. This includes both income and expenses. You can record your transactions manually or using a bookkeeping software program.

- Reconcile your bank statements. This involves comparing your bank statements to your financial records to ensure everything matches.

- Prepare financial statements. Financial statements are reports that summarize your financial data. The most common financial statements are the balance sheet, income statement, and cash flow statement.

If you are unsure how to do any of these things, many resources are available to help you. You can find books, articles, and online courses on bookkeeping. You can also hire a bookkeeper to help you manage your finances.

Benefits of outsourcing bookkeeping

If you don’t have the time or expertise to do your own bookkeeping, you may want to consider outsourcing it to a professional. There are many benefits to outsourcing bookkeeping, including:

- Accuracy. Professional bookkeepers are trained to keep accurate financial records. This can help you avoid costly tax mistakes.

- Efficiency. Professional bookkeepers can save you time and hassle by handling your bookkeeping.

- Compliance. Professional bookkeepers can help you make sure that you are complying with all applicable tax laws and regulations.

Conclusion

Bookkeeping is essential for all businesses but especially important for small businesses. Good bookkeeping can help you track your finances, identify areas for improvement, make better business decisions, and prepare for future growth. If you don’t have the time or expertise to do your own bookkeeping, consider outsourcing it to a professional.